Frank Renfro (left) and Michael Furnari share many residents frustration with insurance. Photo: RICH SCHMITT/CTN

(Editor’s note: After the Palisades Fire, this editor has received so many emails requesting stories about builders, government programs that require so much documentation that people “throw up their hands,” free mental help, art programs and free holiday decorations. I stopped writing about most of them, because there is so much talk and not real help. I had received information from resident Michael Furnari about ClaimArchitect that assesses insurance construction costs. I was hesitant at first, but learned that Furnari lost his home on Hartzell and had developed this program for his family with partner Frank Renfro, another local. He started working with Pali Builds – a local group, so local construction costs were accurate. CTN tried the program and thought it was helpful. We sent the results to our claim adjustor, who acknowledged it was being reviewed.)

Claim Architect partners Frank Renfro (left) and Michael Furnari go over plans.

Photo: RICH SCHMITT/CTN

Can I afford to rebuild after the Altadena/Palisades Fire, is a central question many are asking. Mike Furnari, a local resident with three small children, lost his home in the fire. He told CTN, “One of the biggest barriers for some people is the uncertainty around true rebuild cost.”

Many residents have said they won’t start the rebuild process until they know if they’ll have enough money. But how do they know? Insurance in many cases has not been helpful in providing answers or adjusters say to send receipts once construction is underway.

Some insurance companies have told residents they can rebuild for $400 to $450 per square foot, which is woefully inaccurate for Los Angeles. Furnari, who partnered with another local, Frank Renfro via PaliBuilds said, “Many people were receiving estimates that didn’t reflect actual rebuild costs.”

ClaimArchitect was started to provide residents with an actual “Extimate” estimate that can be taken to insurance companies. By using an AI-enabled platform, Furnari’s customers are given a replacement cost evaluation, that can be presented to an insurance company.

When one hires ClaimArchitect, either for house reconstruction or for smoke damages assessment, the company asks for your insurance policy and the adjuster’s estimate. The floorplan and any other information a customer can provide are factored in, too.

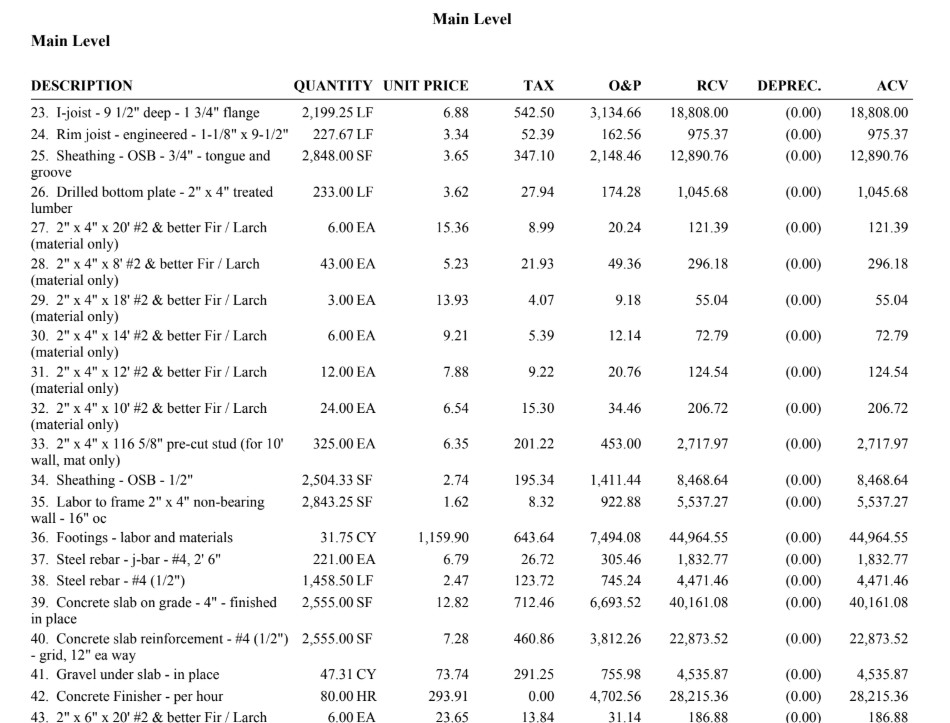

They run that information through the plan and are able to provide a detailed line-by-line unit replacement and price and the actual cost value. This information an “Xactimate” is similar to what insurance companies use.

In our case with State Farm, Furnari said, “This is the first time I’ve ever seen an adjusters estimate that’s just three pages long.” The document that ClaimArchitect generated for this editor’s rebuild was 61 pages long.

According to State Farm the rebuild money our family would receive was $1.125 million, which is under the policy limit.

With all the line-to-line items, including floorboard, knobs, plumbing, the program calculated that it would cost us about $2 million to rebuild. Furnari said, “it’s clearly going to cost more than your coverage maximums, so they [insurance company], at the very minimum, needs to come up to that [policy limit].

He said, “In your case, you have $1.2 million and we’re coming up with approximately 2 million, so that $800,000 loss,” Furnari said and added that some people are using that loss for tax purposes.

One resident who had been paid out in whole by insurance used ClaimArchitect. He told CTN that he was woefully underinsured, but he’s still giving this document to his insurance company. If the insurance company agrees it’s reasonable,” I’m going to claim the loss on taxes, and I think that the IRS would be more likely to honor a document in which insurance agrees the costs are accurate.”

Another resident told CTN “To have this document to give the IRS is so valuable and worth the cost of the program.’

If one is involved in a legal dispute, an accurate assessment of construction or remediation could be helpful to attorneys.

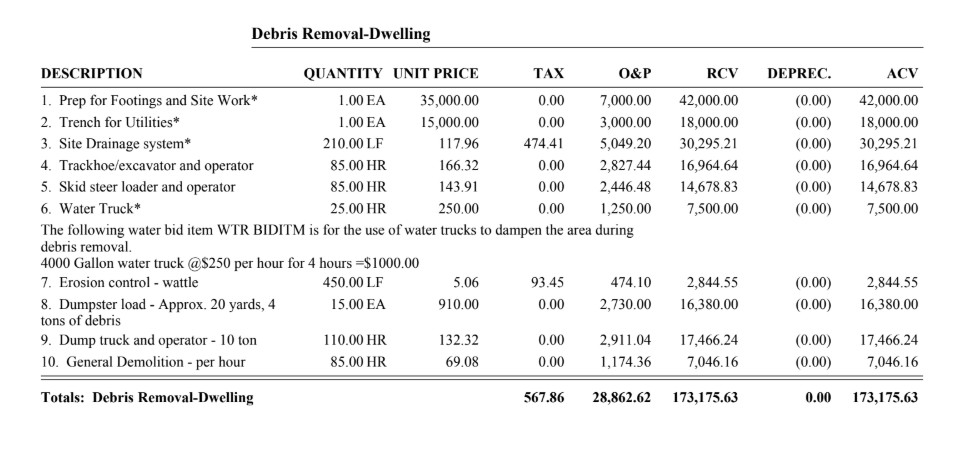

In our insurance policy, we have $50,000 for debris removal. We like many used the Army Corps of Engineers, which only clears the ash footprint. We hired another construction company to removed the remaining hardscape and landscaping that was necessary after the fire. We submitted a claim for the remaining costs and were denied because we were told they needed a line-by-line report. We now have it through Claim Architect, but don’t know if the insurance will pay it, or just give the entire amount in debris removal to ACE.

In short, Furnari’s program 1) Digitally reconstructs the home, 2) Analyzes documents, photos, and homeowner inputs 3) Updates all pricing to current market conditions 4) Adds missing scope items commonly overlooked in initial estimates 5) Produces a builder-reviewed replacement cost evaluation and 6) Helps homeowners understand the realistic cost of rebuilding.

SMOKE DAMAGE

For a home that has smoke damage, the program essentially works the same way, the house is recreated in the document and then the cost is included for drywall, insulation, baseboards, crown molding, cabinets, appliances, plumbing and other finishes if they’re contaminated or must be replaced.

The report breaks the work into line items (labor + materials + unit costs) and uses the same kind structure and language as Xactimate-style estimates, which is what insurance companies use.

This report uses hyper-local costs (Palisades‑specific labor and materials), so for smoke damage one can: show that local unit prices for things like insulation, drywall, trim, etc. are higher than what the insurer is assuming and argue that the insurance companies pricing is too low for the market.

The detail report provides: a formal, third‑party document showing that scope and cost, a document for tax purposes (casualty loss related to smoke damage), a document that might be valuable for potential litigation (against the carrier ).

One can send the line-item report with remediation contractor to the adjuster, so that person sees familiar itemized details.

Furnari pointed out that “Most initial rebuild estimates overlook major construction components. ClaimArchitect fills those gaps.

“This report helps homeowners and builders get aligned on what a real rebuild should cost,” he said and added the group are not public adjusters and offer no legal or insurance advice or claim mediation – just information. https://ClaimArchitect.com.

Claim Architect developed by Michael Furnari gives actual local construction costs.

Photo: RICH SCHMITT/CTN

Super helpful. The other thing residents can do is mention to their insurers that the insurer is in violation of the licensing agreement for Xactimate if they do not use local construction costs to prepare their Settlements.

From the Xactimate User Guide From the Xactimate End User Licensing Agreement Section 12.3:

“We do not warrant the accuracy of pricing information in the Price Data. Price Data is intended to represent historical information and should be used as a baseline or place to begin creation of an estimate. We provide Price Data for informational purposes only. You must ensure that estimates include pricing consistent with actual materials, equipment, labor pricing, etc. You acknowledge and understand that the Price Data provided as part of the Services is intended to target the most representative price of the various price points collected relevant to the specific line item in question. Having this single representative price per line item computed from all valid price points researched in the market means that some market price data is higher and some market price data is lower than that which is reported. You agree not to prohibit or preclude deviations from the Price Data where contractor requirements, market conditions, demand, or any other factors warrant the use of a different line item price in a specific situation.”

Sue,

How does this help if one is already in the process of rebuilding?

Would it only be useful for tax purposes?

How do they set their flat fee for their AI program?

How long did it take to receive the results from request for to final printout?

Thank you!

I’d call them and chat with them–super nice guys.See what they tell you – A flat fee of $5,000. Sue

we had a detailed estimate prepared on Xactimate to recreate our house as built and it came to over $1000 sq ft., more that twice as much as the insurance

Yes—this can still help even if you’re already rebuilding. Finish type, upgrades, and other line items are often missing from adjuster reports.

Some folks use it for more than tax purposes. If litigation arises years from now, this helps document the full scope of loss for those cases as well..

Timeline is typically 7–10 days.

Happy to walk through any of it: [email protected]