This was Tahitian Terrace, a mobile home park that provided affordable living in Pacific Palisades, before it burned during the January 2025 Fire. Now residents have few options.

(Editor’s note: This letter was sent to Senator Ben Allen and to this editor. It raises an important question about allowing those who lived in mobile homes a chance to survive, to find a new home, by a one-time tax transfer for those impacted by the Palisades and Eaton Fires. For all of those politicians who are championing affordability, if you are serious, here’s your chance to step up and help.)

We are in an unfortunate property tax position being mostly older and lower middle class to take full advantage of Prop 19.

Our mobile homes had significant Fair Market Value but our assessed value made our tax basis very low. If we cobbled together SBA loans, insurance settlements and savings, we MIGHT be able to buy a regular home in LA. However, property taxes would make it impossible to afford. I propose a one-time option to transfer our tax basis into new homes so that we can move on based on the amount of time it is going take (I’m 71) to rebuild – if we can rebuild at all.

We didn’t ask for this!

Over 300 Mobile homes in two parks were lost in the Palisades fire. We did not own the land. According to our landowners, they estimate it will take a minimum of at least three years before people would be allowed to return.

I’d like to ask LAWMAKERS to help with a problem that falls into the “Kick ’em while they’re down” category.

Due to the fact it may take years to rebuild the park, many of us as senior citizens don’t have the luxury of time. We would love to buy a home in Los Angeles and settle down to rebuild our lives until the park returns.

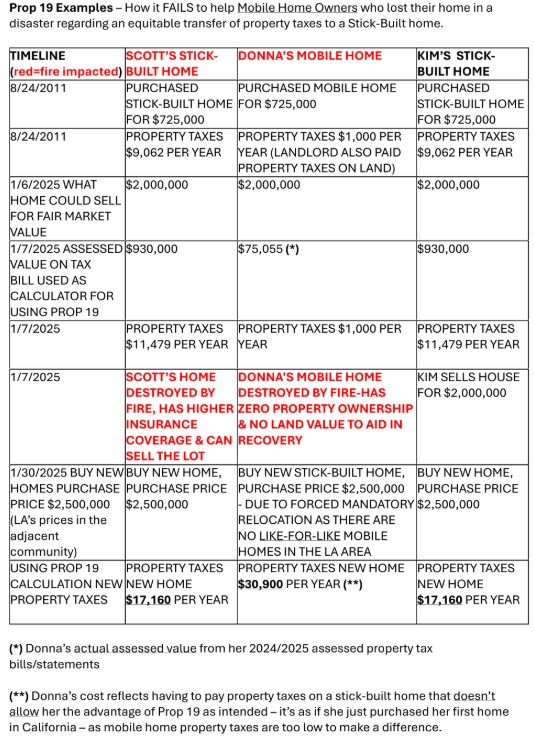

In addition to the high costs of buying in Los Angeles, working against us is a cruel quirk in Prop 19. I’ve attached a chart illustrating the inequities for Mobile Homes vs Stick-Built homes destroyed in the fire and Stick-Built not destroyed in the fire.

Some owners only paid for registration tags, like you would a car, and many, like me paid a property tax through the county tax assessor’s office. We all bought our homes (most recently reaching a million+), and paid monthly rent for our spaces (a wide range of fees that many seniors struggled to afford).

Because the landlord paid the property taxes on the land, we received no credit for taxes they paid but contributed to them as residents in our rents. The “low” property taxes we directly paid can be applied to a new Stick-Built home property tax, but the amounts are so small that the property taxes for us to relocate would be prohibitive, unlike folks in Stick-Built homes who have an advantage of Prop 19 aiding in their recovery from the fire in addition to owning the land which they can sell.

We are reaching out to YOU to support Mobile Homeowners under Prop 19’s inequities. We need help to get some sort of legislation to help change the property tax law for those who can’t take full advantage of Prop 19. We need YOU as our Champion! We need YOU to write us a special dispensation law to lead to a fair and just result.

Donna Burkons